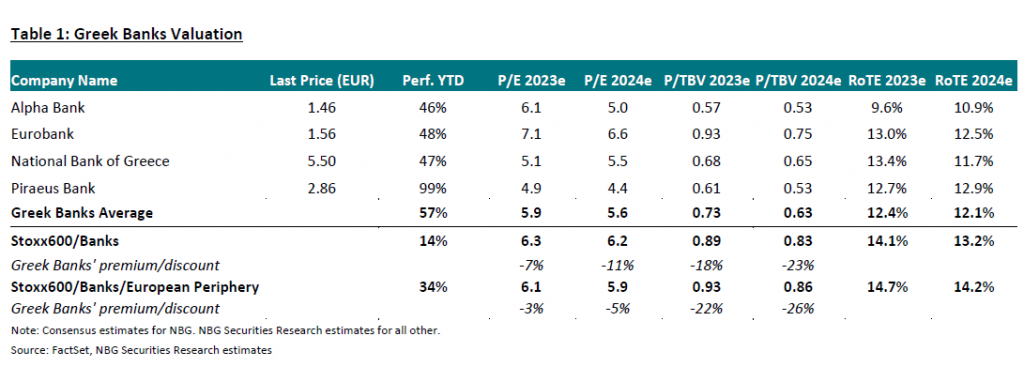

Greek banks overall presented a strong 3rd quarter of 2023 with improved trends in organic earnings before provisions (Core PPI).

That’s the comment from NBG Securities, which notes that Greek banks have maintained strong capital and ample liquidity, which can continue to be invested in higher-yielding assets.

In its comment after the announcement of the results of the Greek banks, the stable Core PPI mainly reflects the benefit of ECB interest rate hikes, which offset the 50bp reduction in interest income (NII) due to the expiry of the TLTRO prime rate; the expansion of the loan portfolio with new disbursements of more than 5.8 billion euros, cumulatively, and

stable operating expenses (OpEx) on a quarterly basis, despite inflationary pressures, supported by banks’ efforts to contain costs.

These trends were also supported by an increase in commission income due to higher volumes of business. In addition, asset quality continued to improve, with the average NPE ratio decreasing by 57 bp, thanks to organic actions as well as NPE sales.

Alpha Bank

Alpha Bank announced 3Q2023 Core PPI of €365m (+18.4% qoq), driven by higher interest rates and increased contribution from securities, offsetting increased deposit costs and increased costs from bonds issued.

On the bottom line, Alpha reported earnings from continuing operations of €208m vs €191m in Q2 2023, also benefiting from higher commissions, and lower Opex.

Non-performing exposures fell by €0.1bn quarter-on-quarter to €2.9bn, as consistently lower organic inflows were more than offset by strong treatment activity and repayments. NPEs shrank to 7.2%, down 40 bp. compared to the 2nd quarter, while the coverage of NPEs stood at 40.8%, increased by 1.2% on a quarterly basis.

Alpha Bank’s capital position strengthened in Q3, with the FL CET1 ratio standing at 13.9%, compared to 13.6% in Q2, while the Total Capital ratio stood at 18.2% in Q3 compared to 18, 0% in the 2nd quarter.

Eurobank

Eurobank reported Core PPI of €462m in Q3 (+0.7% qoq), thanks to loans, bonds, derivatives and international operations. The bottom line was €318m (-7.4%) before one-off, as increased NII and higher commissions were offset by lower trading and other income and increased OpEx.

Gross loans expanded by €66m to €42.2bn in Q3. NPLs decreased by 145 million to 2.1 billion. The NPL ratio decreased to 4.9% from 5.2% in Q2 and 5.6% in Q3 2022.

Eurobank’s capital position strengthened in 9M – total CAD to 19.5% and FLCET1 to 16.8% in 9M, up 230 bp. and 260 m.v. on an annual basis respectively.

National Bank of Greece

The EIB reported Core PPI of €481m (+7.5% qoq), supported by core rate repricing which benefited loan interest income, despite loan margin compression, rising term deposit costs (in euro terms) by 31 m.v. on a quarterly basis (at 156 bp), as well as higher wholesale funding costs.

Profits after taxes from continuing operations amounted to 353 million euros (+19.9%). The stock of non-performing exposures decreased by €570 million to €1.2 billion, with almost zero organic NPL formation after the last NPL transaction. NPE ratio decreased to 3.7% (vs. 5.4% in 2Q2023) and coverage increased to 93.1% (vs. 82.1% in 2Q2023).

FL CET1 rose 0.6% to 17.9%, supported by strong organic profitability. The total equity ratio (CAD) stood at 20.3%.

Piraeus Bank

Piraeus Bank posted Core PPI of €457 million (+10.9% quarter-on-quarter), supported mainly by the favorable interest rate environment and the management of deposit costs. Fee income was lower in Q3 as seasonally softer new loan origination activity weighed on performance, while Opex was also lower as the Bank continued to pursue resource optimization as part of its transformation program.

Net Profit from continuing operations was €277 million (+131.8% quarter-on-quarter), also affected by lower forecasts and the non-recording of intangible impairment charges during this quarter.

Non-performing exposures remained at €2 billion in Q3, down 39% year-on-year, supported by both the execution of the Group’s restructuring plan and organic reduction. Consequently, the NPE ratio remained at the level of 5.5%, significantly lower than at the end of September 2022 (8.8%).

Piraeus Bank’s CET1 ratio at the end of September reached the level of 12.9%, mainly due to organic capital formation. The overall CAD ratio stood at 17.6%, comfortably above capital requirements as well as supervisory guidelines.

Latest News

Greek €200M 10Y Bond to be Issued on April 16

The 3.875% fixed-interest-rate bond matures on March 12, 2029, and will be issued in dematerialized form. According to PDMA, the goal of the re-issuance is to meet investor demand and to enhance liquidity in the secondary bond market.

German Ambassador to Greece Talks Ukraine, Rise of Far Right & Tariffs at Delphi Economic Forum X

Commenting on the political developments in his country, the German Ambassador stressed that it was clear the rapid formation of a new government was imperative, as the expectations across Europe showed.

Athens to Return Confiscated License Plates Ahead of Easter Holiday

Cases involving court orders will also be excluded from this measure.

Servicers: How More Properties Could Enter the Greek Market

Buying or renting a home is out of reach for many in Greece. Servicers propose faster processes and incentives to boost property supply and ease the housing crisis.

Greek Easter 2025: Price Hikes on Lamb, Eggs & Sweets

According to the Greek Consumers’ Institute, hosting an Easter dinner for eight now costs approximately €361.95 — an increase of €11 compared to 2024.

FM Gerapetritis Calls for Unified EU Response to Global Crises at EU Council

"Europe is navigating through unprecedented crises — wars, humanitarian disasters, climate emergencies," he stated.

Holy Week Store Hours in Greece

Retail stores across Greece are now operating on extended holiday hours for Holy Week, following their Sunday opening on April 13. The move aims to accommodate consumers ahead of Easter, but merchants remain cautious amid sluggish market activity.

Green Getaway Ideas for Easter 2025 in Greece

Celebrate Easter 2025 in Greece the sustainable way with eco-farms, car-free islands, and family-friendly getaways rooted in nature and tradition.

Civil Protection Minister Details Summer Firefighting Plans at Delphi Forum

At the 10th Delphi Economic Forum, Minister of Climate Crisis and Civil Protection Yiannis Kefalogiannis discussed Greece's plans for the upcoming fire season.

How Shops and Markets Will Operate During Easter Holy Week

The Easter holiday schedule has been in effect since April 10, with retail stores open Palm Sunday, and most supermarkets also operating to meet consumer demand for Easter shopping

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης