Positive prospects are opening up in the Greek banking sector after the latest moves by the Financial Stability Fund to allocate its stakes to Alpha Bank and National BAnk, according to Deutsche Bank, which even raised the target prices of the bank shares, in order to capture the new updated forecasts for interest income (IIR) and return on capital.

In particular, for National Bank, the target price is increased to 8.30 euros, from 7.10 euros previously, while the recommendation is also upgraded to buy, from neutral previously. For Deutsche Bank, the share of National Bank is its top choice among Greek banks.

Deutsche Bank continues with the buy recommendation on both Eurobank and Alpha Bank, with also improved target prices, to 2.40 euros (from 2.05 euros) and 2.15 euros (from 2 euros) respectively. For Piraeus, the recommendation is hold, but with an increased target price to 3.95 euros from 3.30 euros, as the stock has less room for upside after its excellent performance.

Balance sheets continue to improve

These returns will continue in the current quarter as the improvement in interest income is expected to peak in the fourth quarter of 2023 or the first quarter of 2024 due to European Central Bank interest rates. However, the levels will be maintained, while the contribution of credit expansion will also be important.

According to Deutsche Bank, the Greek banking sector will manage to keep costs under control, with the improvement of credit quality maintaining the downward trend of the provisions. Funds, especially Core Equity Tier 1 ratios are expected to reach 15% – 18% by 2024.

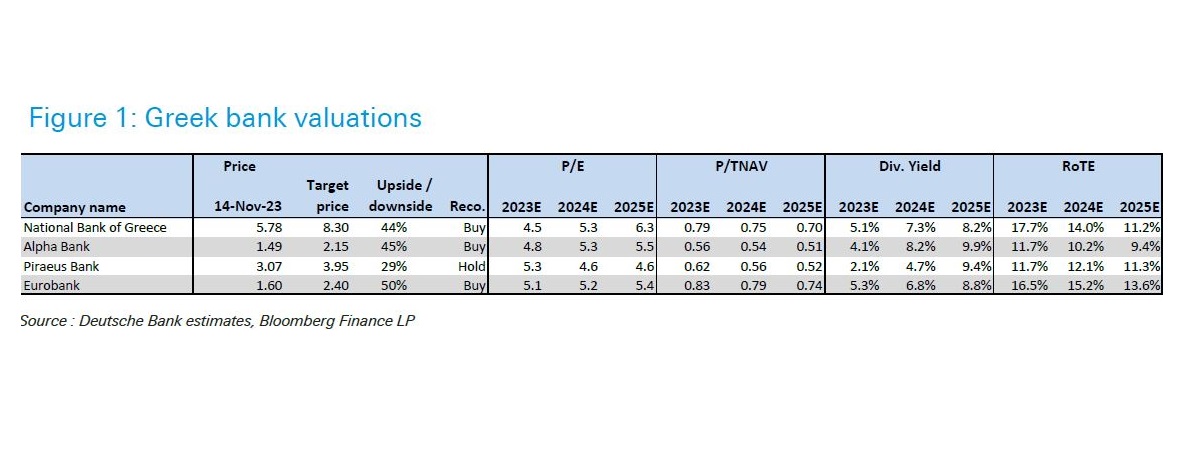

The valuations

The results of the Greek banks confirm the positive course of the sector, as reported by Deutsche Bank, as well as their strong (solid) capital position.

According to Deutsche Bank, the correction of the last interval is mainly attributed to the movements to secure the considerable profits from the beginning of the year, but also the concerns about the disinvestment of the Financial Stability Fund. These concerns are now lifted, especially after the placement for 22% of National Bank, with the shares trading at a Price/Earnings ratio of 5x, based on 2024 estimates and P/TBVs at 0.5x – 0.8x. Evaluations are made with a ROTE efficiency index of 10% – 15%.

Latest News

Greece Defines Continental Shelf Limits and Maritime Zones in Landmark EU Document

The Maritime Spatial Planning (MSP) framework represents a comprehensive approach to spatial planning and is crucial for the successful development of a blue and circular economy

EU Praises Greece’s RRF Progress as Revised Recovery Plan Nears Completion

Athens is preparing to submit its revised “Greece 2.0” Recovery and Resilience Plan after Easter, with a slight delay from the initial timeline but with the European Commission’s approval.

Greek €200M 10Y Bond to be Issued on April 16

The 3.875% fixed-interest-rate bond matures on March 12, 2029, and will be issued in dematerialized form. According to PDMA, the goal of the re-issuance is to meet investor demand and to enhance liquidity in the secondary bond market.

German Ambassador to Greece Talks Ukraine, Rise of Far Right & Tariffs at Delphi Economic Forum X

Commenting on the political developments in his country, the German Ambassador stressed that it was clear the rapid formation of a new government was imperative, as the expectations across Europe showed.

Athens to Return Confiscated License Plates Ahead of Easter Holiday

Cases involving court orders will also be excluded from this measure.

Servicers: How More Properties Could Enter the Greek Market

Buying or renting a home is out of reach for many in Greece. Servicers propose faster processes and incentives to boost property supply and ease the housing crisis.

Greek Easter 2025: Price Hikes on Lamb, Eggs & Sweets

According to the Greek Consumers’ Institute, hosting an Easter dinner for eight now costs approximately €361.95 — an increase of €11 compared to 2024.

FM Gerapetritis Calls for Unified EU Response to Global Crises at EU Council

"Europe is navigating through unprecedented crises — wars, humanitarian disasters, climate emergencies," he stated.

Holy Week Store Hours in Greece

Retail stores across Greece are now operating on extended holiday hours for Holy Week, following their Sunday opening on April 13. The move aims to accommodate consumers ahead of Easter, but merchants remain cautious amid sluggish market activity.

Green Getaway Ideas for Easter 2025 in Greece

Celebrate Easter 2025 in Greece the sustainable way with eco-farms, car-free islands, and family-friendly getaways rooted in nature and tradition.

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης