Today is the second and final day of the Morgan Stanley-Athens Stock Exchange (ASE) Roadshow in London, and while investors have initially received Greece positively, they will be looking for solid answers to tough questions during B2B and side meetings, according to OT.gr.

The key questions being asked by investors following the first day of meetings are related to the prospects of Greek banks maintaining profitability ahead of an interest rate cut from the European Central Bank (ECB), as well as the realistic prospects of an upgrade to the Athens Stock Exchange.

Greek Banks

The Greek banking sector is in the spotlight due to the continued divestment of banks by the Greek state, which is attractive to investors and evidence of the country’s commitment to continued reform. Eurobank and Alpha Bank have been fully privatized and the National Bank of Greece is working on the residual 18pct and the Hellenic Financial Stability Fund on the Bank of Piraeus’ remaining 27pct.

While the mood is generally upbeat, the banks’ management will be queried on the high level of deferred tax assets embedded in their capital structures, which makes it hard for banks to absorb potential losses, as well as on how they will maintain profitability as their income is close to peaking.

Recently analysts have noted the Greek banks still have weak capital quality – insufficient capital or low-quality assets – and that the prospects for improvement are low, which has caused some analysts such as S&P to limit their ratings.

As a result, investors want to know how banks plan to maintain profitability and avoid risking their capital base, particularly in view of the prospects of the ECB cutting interest rates, which will have a negative impact on interest income.

Most analysts consider that the interest income (NII) of Greek banks will peak this or next quarter, which is key for the mid to long-term prospects for banks and for those with exposure to the Greek sector or who are looking to acquire. Exceptionally, JP Morgan sees NII stabilizing, pending banks increase their loan volumes, boosted by the Recovery Fund capital.

The Athens Stock Exchange

The second key area in focus relates to the realistic prospects of upgrades to the Greek stock market. Representatives of the Hellenic Financial Markets Authority (HFMA) will have to address issues surrounding the low quality of several funds operating in the Greek market, as well as the fact that turnover remains at around 100 million euros. Therefore, the HFMA will have to keep any prospects of upgrades to developed markets grounded in ‘reality.’

The management of the ASE has indicated that the prospect of an upgrade is likely over the next 18 months, especially due to the fact that the Greek economy has achieved investment grade. However, this requires the existence of an appropriate regulatory and supervisory framework to protect investors and enhance the efficacy of the regulatory processes, with the aim of expediting decision-making timelines and offering new innovative tools and products.

The ASE estimates that firms will put the stock exchange on a “watch list” for an upgrade, which will be an important signal for the strengthening of investors’ positions in Greek equities. Besides, emerging markets, in which the stock exchange is “trapped,” constitute a very small part of the global investment pie and attract small funds. For example, the weighting of emerging markets in the MSCI global index is only 13%.

On the roadshow, it is important to note that the 2-day roadshow kicked off yesterday at the Morgan Stanley London Conference Center and that it is the first time that Morgan Stanley and the ASE partnered to organize a Greek Investment Conference. Prime Minister Kyriakos Mitsotakis opened the event yesterday and highlighted the government’s readiness for reform after the country’s investment-grade rating from international rating agencies was recently reintroduced.

The ASE said in November that the event “aims to support Greek entrepreneurship, by highlighting investment opportunities in the Greek capital market and enhancing institutional trust in the country.” The event is comprised of one-on-one and small group meetings between the ASE’s biggest companies and international funds. There are also panel discussion sessions, networking events, and presentations in partnership with four of Greece’s banks: Alpha Bank, Eurobank, National Bank of Greece, and Piraeus Bank.

In relation to the Greek banking sector, the Bank of Greece reported that as of June 2023, Deferred Tax Credits amounted to 13.4 billion while the banking sector’s regulatory capital includes Deferred Tax Assets of 2.4 billion euros (approx 9pct).

Source: tovima.com

Latest News

Eurozone Inflation Eases to 2.2% in March

Compared to February, inflation decreased in 16 member states, remained unchanged in one, and rose in ten.

Bank of Greece: Primary Gov. Surplus €4.1b Jan.-March 2025

The data released today by the Bank of Greece revealed that the central government’s overall cash balance recorded a surplus of €1.465 billion in the first quarter of 2025, compared to a deficit of €359 million in the corresponding period of 2024.

Greek Government Reissues 10-Year Bond Auction for €200 Million

The amount to be auctioned will be up to 200 million euros, and the settlement date is set for Friday, April 25, 2025 (T+5)

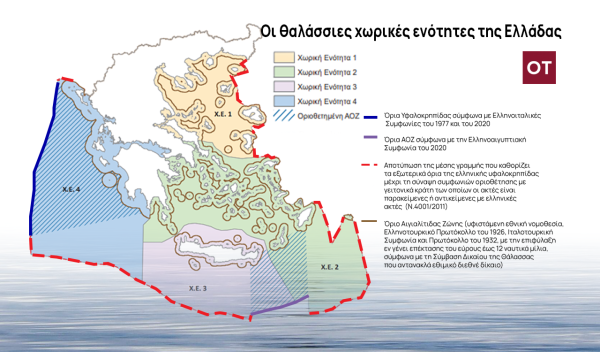

Greece Defines Continental Shelf Limits and Maritime Zones in Landmark EU Document

The Maritime Spatial Planning (MSP) framework represents a comprehensive approach to spatial planning and is crucial for the successful development of a blue and circular economy

EU Praises Greece’s RRF Progress as Revised Recovery Plan Nears Completion

Athens is preparing to submit its revised “Greece 2.0” Recovery and Resilience Plan after Easter, with a slight delay from the initial timeline but with the European Commission’s approval.

Greek €200M 10Y Bond to be Issued on April 16

The 3.875% fixed-interest-rate bond matures on March 12, 2029, and will be issued in dematerialized form. According to PDMA, the goal of the re-issuance is to meet investor demand and to enhance liquidity in the secondary bond market.

German Ambassador to Greece Talks Ukraine, Rise of Far Right & Tariffs at Delphi Economic Forum X

Commenting on the political developments in his country, the German Ambassador stressed that it was clear the rapid formation of a new government was imperative, as the expectations across Europe showed.

Athens to Return Confiscated License Plates Ahead of Easter Holiday

Cases involving court orders will also be excluded from this measure.

Servicers: How More Properties Could Enter the Greek Market

Buying or renting a home is out of reach for many in Greece. Servicers propose faster processes and incentives to boost property supply and ease the housing crisis.

Greek Easter 2025: Price Hikes on Lamb, Eggs & Sweets

According to the Greek Consumers’ Institute, hosting an Easter dinner for eight now costs approximately €361.95 — an increase of €11 compared to 2024.

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-600x450.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης