The Bank of Greece (BoG) issued a press release informing the public it would be enacting a series of measures linked to loans and other credit for individuals secured by residential real estate.

The measures are aimed at preventing or mitigating systemic risks stemming from the real estate market in Greece and are associated with households and/or businesses lending secured by residential or commercial real estate.

The press release reads as follows:

The Bank of Greece enacted macroprudential measures for loans and other credit to natural persons secured by residential real estate

The Bank of Greece enacted macroprudential borrower-based measures for loans and other credit to natural persons secured by residential real estate located in Greece.

These measures are binding and take the form of caps on the debt-service-to-income at origination (DSTI-O) ratio and the loan-to-value at origination (LTV-O) ratio.

The measures will become applicable on 1 January 2025.

The Bank of Greece enacted macroprudential borrower-based measures (BBMs) for loans and other credit to natural persons secured by residential real estate (RRE) located in Greece by Executive Committee Act 227/1/08.03.2024 (Government Gazette B 1716, 15.03.2024).

These measures comprise:

a cap on the debt service-to-income ratio at origination (DSTI-O ratio) of 50% for first-time buyers and 40% for second and subsequent buyers, and

a cap on the loan-to-value ratio at origination (LTV-O ratio) of 90% for first-time buyers and 80% for second and subsequent buyers.

The abovementioned BBMs shall not apply to non-performing loans and forborne loans (within the meaning of Articles 47a and 47b, respectively, of Regulation (EU) No 575/2013 of the European Parliament and the Council), to loans and other credit disbursed under national housing policy or green transition programmes subject to specific terms and conditions (such as the “My Home” loan programme), as well as portfolios of re-performing loans purchased by credit institutions from NPL servicers licensed under Law 5072/2023.

Credit providers are allowed to exempt 10% of the total number of new loans approved and at least partially disbursed in each quarter from each of the abovementioned caps.

The power to introduce BBMs is conferred upon the Bank of Greece by means of Article 133A of Law 4261/2014.

Related information:

Macroprudential borrower-based measures: these measures mainly consist of caps on ratios relating to credit provision, borrowers or individual credit features. They are aimed at preventing or mitigating systemic risks stemming from the real estate market in Greece and are associated with lending to households and/or businesses secured by residential or commercial real estate. BBMs also help prevent excessive loosening of credit standards and strengthen the resilience of the financial system. These measures are complementary to other macroprudential measures used to address cyclical and structural systemic risks such as the Other Systemically Important Institutions buffer (O-SII buffer).

Debt service-to-income at origination (DSTI-O) ratio: the annual debt servicing costs of the total debt of the borrower divided by the borrower’s total annual disposable income at the time of loan/credit origination.

Loan-to-value at origination (LTV-O) ratio: the total amount of the loan or loan tranches secured by real estate property at the time of origination divided by the value of the real estate collateral at the time of origination.

First-time buyer: a borrower who has not been granted a loan or credit secured by residential real estate in the past.

More information on macroprudential policy can be found here.

Latest News

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

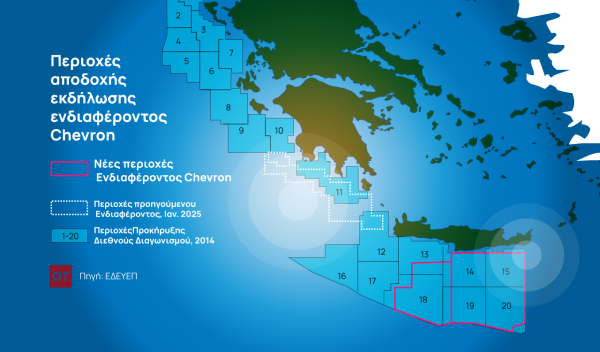

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-600x500.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης