Leading companies and investment funds are showing increasing interest in Greece, on account of the massive interconnector projects in the pipeline, as the world grows thirsty for more renewable energy.

The massive Great Sea Interconnector project, which aims to connect Greece, Cyprus and Israel through underwater electrical cables, put Greece in the spotlight again on Monday when it was announced that French Meridiam Fund was also entering the fray and has signed a Memorandum of Understanding with Greece’s Independent Power Transmission Operator’s (IPTO – ADMIE).

The Greece-Cyprus-Israel electrical interconnector is considered to be one of the world’s largest electrical connector projects, and will lay cables at depths up to 3,000 meters and using innovative converter station technology.

In addition to the Great Sea Interconnector project, two other significant interconnector projects, called the Green Aegean (Greece-Germany) and GREGY (Greece-Egypt), are also making waves.

According to reports at TO VIMA, the following funds are circling around the interconnector projects connected to Greece.

Meridiam Fund’s Investment

Meridiam’s intention to enter the shareholder structure of the Great Sea Interconnector follows its recent interest in acquiring 20% of Ariadne Interconnection, the company constructing the major Crete-Attica link.

Meridiam replaced the Australian Macquarie fund, which had withdrawn from the consortium with FAETHON Single Shareholder Company of Holdings, in the Ariadne project.

According to ADMIE officials, Meridiam’s dual interest in the Attica-Crete and Crete-Cyprus cables signals confidence in ADMIE’s investment plans.

Meridiam is a Paris-based global investor operating in 56 countries with assets worth $22 billion, and specializes in developing, financing, and managing long-term public infrastructure projects. It is the primary investor in NeuConnect, the first electrical link between the UK and Germany, which is currently under construction.

DFC and TAQA Funds

In addition to the French fund, ADMIE is continuing discussions with potential investors for equity participation in the Great Sea Interconnector project. Agreements have been made with the U.S. government fund DFC, which is expected to send its term sheet (proposed financing terms) in the coming days, following a recent letter of intent that was sent to the implementing body of the project.

A teleconference last Friday, involving ADMIE officials, the Cypriot Ministry of Energy, Commerce, and Industry, and the EU Directorate of Energy, made progress on the regulatory framework that will also enable the participation of Abu Dhabi’s state fund TAQA.

ADMIE Negotiations

ADMIE is also negotiating with Greek commercial banks and the Bank of Cyprus, which has started the technical and financial evaluation of the project for potential funding involvement.

The Great Sea Connector project cost is estimated at €1.94 billion, up from the €1.57 billion estimated in 2017, with costs distributed 63% to Cyprus and 37% to Greece. The project has secured €657 million in funding from the Connecting Europe Facility (CEF).

Interest in Green Aegean Interconnector and GREGY

The Green Aegean Interconnector, the major Greece-Central Europe electrical link, has also become a hub of significant business developments, as it aims to transport 3 GW of green energy from Greece to Munich via the Adriatic, Slovenia and Austria.

Tennet, a top high-voltage network operator in the Netherlands and Germany, has expressed interest and a teleconference with ADMIE executives and the energy ministries of Greece and Germany is scheduled for early July.

Tennet operates about 23,900 kilometers of high-voltage lines and cables, supplying electricity to 42 million households and businesses.

The company’s potential involvement in the project is viewed positively, according to TO VIMA, because it may create synergies with the GREGY interconnector project that will link Greece and Egypt via underwater cables.

Copelouzos Group

For the GREGY electrical interconnection, in which ADMIE will hold up to a 33.3% stake, key studies for the final cable routing and cost-benefit analysis are set to be assigned soon, with over twenty companies expressing interest.

The project’s dossier must be submitted by October in order to get up to 50% co-financing from the European Connecting Europe Facility (CEF).

The GREGY project is supported by the Egyptian government, with the Egyptian Electricity Transmission Company (EETC) expected to participate with a 33.3% stake.

Source: tovima.com

Latest News

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

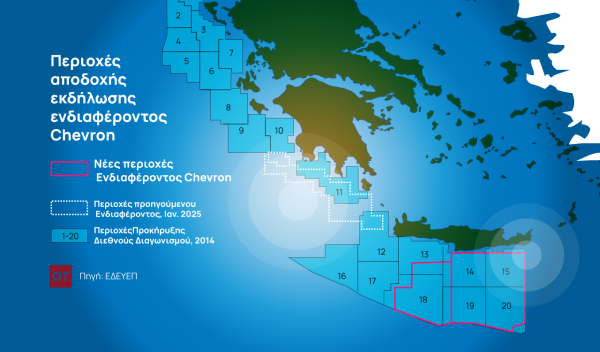

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![ΙΟΒΕ: Πώς το δημογραφικό υπονομεύει την ανάπτυξη – Τι συμβαίνει στις ελληνικές περιφέρειες [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/04/dimografiko-600x375.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-600x500.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης