Greece’s tax bureau on Thursday announced that it has “netted” no less than 287 Chinese-owned retail businesses – mostly apparel and footwear – involved in systemic tax evasion, part of an investigation code-named operation “Paper Dragon”. Results of the investigation were presented by Giorgos Pitsilis, the head of the Independent Authority for Public Revenue (AADE or IAPR), as the tax bureau is official called, indicative of its seriousness.

Pitsilis described a complex and inter-locking network of entrepreneurs, accountants and even an IT company involved in tax evasion and avoidance. He said tax auditors were first notified by anonymous complaints against a business based in the northeast city of Komotini, another in the central city of Larissa and a third with a branch in Thessaloniki.

According to reports, it was unrecognizable QR codes on cash register receipts given to customers for their purchases that generated the first complaints.

A further investigation revealed that a local software company with a Greek national as its legal representative was involved with all 287 audited businesses, along with two Chinese nationals residing in Slovakia. The latter two are charged with providing technical expertise to shop-owners in order to rig their cash registers.

Some of the 287 businesses scrutinized by the tax bureau’s in operation Paper Dragon have another 10 to 15 outlets around Greece, leading authorities to calculate millions of euros in uncollected VAT remittances and corporate taxes.

AADE debuted a new app last January to combat tax evasion and VAT avoidance. Specifically, users can download the app to check whether the receipts they are given are genuine or fake.

The app, called “Appodixi” enable consumers to file complaints with their own personal data or anonymously.

The Appodixi application is accessible via mobile phone, and more than 250,000 users downloaded it in the weeks after its debut.

Dependent upon on AADE’s algorithms, complaints are prioritized and automatically channelled to tax authorities for further investigation.

Source: tovima.com

Latest News

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

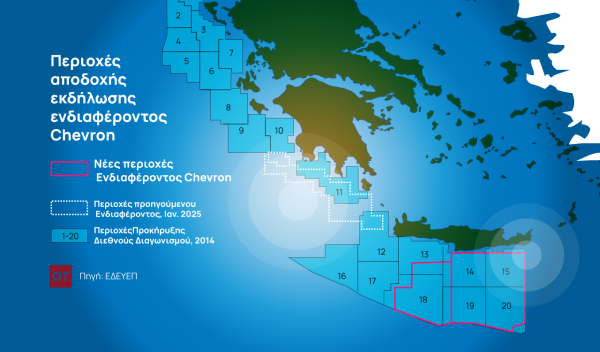

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-600x500.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης