Amerger between Pancreta Bank and Attica Bank is expected to be completed in mid-September, according to an announcement by the latter on Wednesday, “assuming” all necessary corporate decisions by the two institutions are taken, along with regulatory approvals and licenses.

The announcement comes in the wake of another high-profile warning by Bank of Greece (BoG) Gov. Yannis Stournaras, during statements on Wednesday before a Parliament committee. The central banker said the solution with the merger with Pancreta is the best available for both credit institution stability and the Greek taxpayer.

Stournaras continued by saying that if the current deal falls through then the Hellenic Financial Stability Fund’s participation is lost and that the Greek state would lose 1.8 billion euros.

The Attica Bank announcement reads:

Further to the Shareholders’ Agreement dated 18 July 2024 (the “Agreement”) between the Hellenic Financial Stability Fund and Thrivest Holding Ltd (together, the “Shareholders”), the Bank initiated the necessary actions for the implementation of the specific provisions of the Agreement and the commitments of the Shareholders for the capital enhancement of the credit institution that will result following the merger between Attica Bank and Pancreta Bank (“New Bank”) for the purpose of implementing the business plan of the New Bank and the coverage of the additional capital requirements that will arise from the inclusion of portfolios of non-performing exposures of the two banks in the “Hercules III” state guarantee program.

In this context: (a) The Bank has initiated the securitization process of a portfolio of non-performing exposures with a total book value of €2.3bn, and has applied for the inclusion of the senior notes of the securitization in the Hercules III State Guarantee Programme, with a total value of €750m, and (b) the Board of Directors of the Bank decided to initiate the merger process between Attica Bank and Pancreta Bank, by absorption of Pancreta Bank by Attica Bank, in accordance with the relevant provisions of company law, L.2515/1997 and L.4601/2019 as applicable and in force (the “Merger”).

A similar decision for the commencement of the Merger procedures was also taken by the Board of Directors of Pancreta Bank.

- Key terms of the Merger The date of the transformation balance sheet will be December 31st 2023 and the proposed exchange ratio (the “Exchange ratio”) will be calculated with relative valuation of the merging entities divided into a ratio of 90% for Attica Bank and 10% for Pancreta Bank, on the basis of relevant analysis and recommendation by the international independent financial institution UBS, which acts as financial advisor to the Bank for the purposes of the Merger.

The Exchange Ratio is subject to the receipt by the Boards of Directors of Attica Bank and Pancreta Bank of fairness opinions by independent certified auditors, as appointed, in accordance with the provisions of L.2515/1997 and L.4601/2019. The completion of the Merger is subject to the approval of the Merger by each of the General Meetings of the merging entities and the receipt of the licenses and approvals required by law by the competent authorities, in accordance with the provisions of applicable law.

- Main points of the transaction The Merger will bring significant benefits to Attica Bank and its shareholders:

- It is a pre-requisite action for the subsequent capital enhancement of the credit institution resulting from the Merger, in accordance with the commitments and as provided for in the Shareholders’ Agreement.

- It will lead to the creation of a single financial institution which is estimated to have an NPE ratio below 3%, subject to the inclusion of NPE portfolios of the two credit institutions in the Hercules III State Guarantee Programme.

- With the intended merger and integration of Pancreta Bank’s assets, customers, branches and staff, the Bank will further increase its competitiveness compared to other banks, significantly expand its network and operations across the country and increase its turnover and subsequently its profitability.

- It will lead to economies of scale in the case of administrative costs and, in general, to the reduction of operating costs and to the maximization of the efficiency of the administrative organization of the merging credit institutions.

- HFSF rights

The special rights of the Hellenic Financial Stability Fund (“HFSF”), as provided for in L.3864/2010 and the Framework Agreement between Attica Bank and the HFSF (RFA), remain unchanged.

- Indicative

Timetable of the Merger

The Merger is expected to be completed by mid-September 2024, subject to all necessary corporate decisions of the merging credit institutions and the required licenses and approvals of the competent authorities according to the Law.

In any case, the timing of the Merger depends on unforeseen factors and is subject to change. The Bank will inform investors with regards to the implementation of all steps of the Shareholders’ Agreement.

Source: tovima.com

Latest News

Greek Government Reissues 10-Year Bond Auction for €200 Million

The amount to be auctioned will be up to 200 million euros, and the settlement date is set for Friday, April 25, 2025 (T+5)

Greece Defines Continental Shelf Limits and Maritime Zones in Landmark EU Document

The Maritime Spatial Planning (MSP) framework represents a comprehensive approach to spatial planning and is crucial for the successful development of a blue and circular economy

EU Praises Greece’s RRF Progress as Revised Recovery Plan Nears Completion

Athens is preparing to submit its revised “Greece 2.0” Recovery and Resilience Plan after Easter, with a slight delay from the initial timeline but with the European Commission’s approval.

Greek €200M 10Y Bond to be Issued on April 16

The 3.875% fixed-interest-rate bond matures on March 12, 2029, and will be issued in dematerialized form. According to PDMA, the goal of the re-issuance is to meet investor demand and to enhance liquidity in the secondary bond market.

German Ambassador to Greece Talks Ukraine, Rise of Far Right & Tariffs at Delphi Economic Forum X

Commenting on the political developments in his country, the German Ambassador stressed that it was clear the rapid formation of a new government was imperative, as the expectations across Europe showed.

Athens to Return Confiscated License Plates Ahead of Easter Holiday

Cases involving court orders will also be excluded from this measure.

Servicers: How More Properties Could Enter the Greek Market

Buying or renting a home is out of reach for many in Greece. Servicers propose faster processes and incentives to boost property supply and ease the housing crisis.

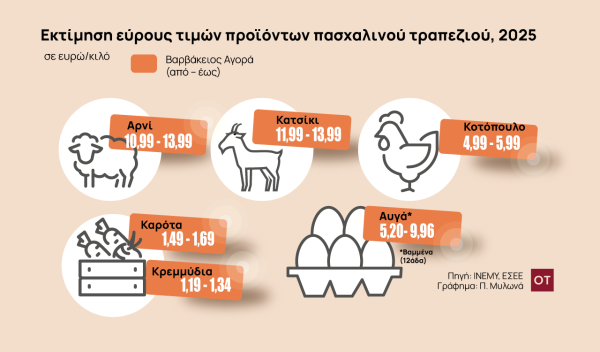

Greek Easter 2025: Price Hikes on Lamb, Eggs & Sweets

According to the Greek Consumers’ Institute, hosting an Easter dinner for eight now costs approximately €361.95 — an increase of €11 compared to 2024.

FM Gerapetritis Calls for Unified EU Response to Global Crises at EU Council

"Europe is navigating through unprecedented crises — wars, humanitarian disasters, climate emergencies," he stated.

Holy Week Store Hours in Greece

Retail stores across Greece are now operating on extended holiday hours for Holy Week, following their Sunday opening on April 13. The move aims to accommodate consumers ahead of Easter, but merchants remain cautious amid sluggish market activity.

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης