Swiss-based UBS investment bank has increased the target price for two Greek banks, Alpha Bank and National Bank of Greece (NBG), maintaining a buy recommendation for both.

The target price for Alpha Bank was set at €2.32 from €2.30 and for National Bank of Greece at €11.20 from €11. The upgrading for the two Greek banks comes after the impressive corporate results of the second quarter for both banks.

UBS revised the EPS (earnings per share) for the National Bank of Greece upwards by approximately 6% for the fiscal year 2024 and 4% for the fiscal year 2026. This comes from a combination of higher net interest income (NII) (2%), higher fee income (1.3%), lower operating expenses (-2.5%), and lower credit loss charges (-7%).

As UBS says the key trend is that NII is holding up better than expected, with NIM now expected around 3.00% from <2.90% previously, leading to an upgrade in NII prospects, with a slight increase for FY24 instead of a previous decline (1%-3%).

The target price was set 2% higher at €11.20, indicating significant capital growth, while also seeing the potential for higher than planned distributions over time as the CET1 ratio continues to accumulate (18.3% after dividend accumulation in H2).

UBS upgraded adjusted earnings per share by 4% to 33c for Alpha Bank in line with the company’s guidance, although medium-term forecast changes are minor.

The weak credit picture in Q2 stands out, with a strong recovery in corporate credit needed in H2 to meet our forecast. The cleanup of non-performing exposures accelerated, with the non-performing exposure ratio dropping from 6% to 4.7% at a cost of under €100 million. Credit quality remains weaker than peers, with lower provision coverage, but credit loss provisions have also decreased. Our target price is only 1% higher at €2.32, indicating significant capital growth.

Source: tovima.com

Latest News

Greek Government Reissues 10-Year Bond Auction for €200 Million

The amount to be auctioned will be up to 200 million euros, and the settlement date is set for Friday, April 25, 2025 (T+5)

Greece Defines Continental Shelf Limits and Maritime Zones in Landmark EU Document

The Maritime Spatial Planning (MSP) framework represents a comprehensive approach to spatial planning and is crucial for the successful development of a blue and circular economy

EU Praises Greece’s RRF Progress as Revised Recovery Plan Nears Completion

Athens is preparing to submit its revised “Greece 2.0” Recovery and Resilience Plan after Easter, with a slight delay from the initial timeline but with the European Commission’s approval.

Greek €200M 10Y Bond to be Issued on April 16

The 3.875% fixed-interest-rate bond matures on March 12, 2029, and will be issued in dematerialized form. According to PDMA, the goal of the re-issuance is to meet investor demand and to enhance liquidity in the secondary bond market.

German Ambassador to Greece Talks Ukraine, Rise of Far Right & Tariffs at Delphi Economic Forum X

Commenting on the political developments in his country, the German Ambassador stressed that it was clear the rapid formation of a new government was imperative, as the expectations across Europe showed.

Athens to Return Confiscated License Plates Ahead of Easter Holiday

Cases involving court orders will also be excluded from this measure.

Servicers: How More Properties Could Enter the Greek Market

Buying or renting a home is out of reach for many in Greece. Servicers propose faster processes and incentives to boost property supply and ease the housing crisis.

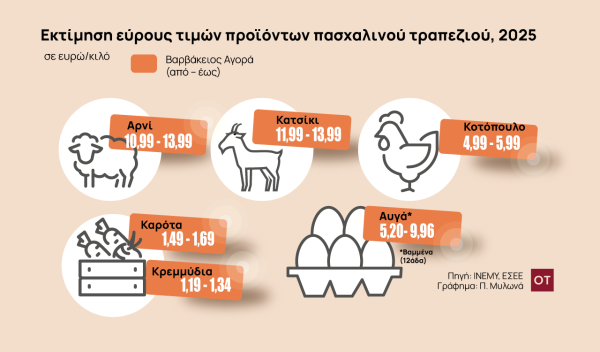

Greek Easter 2025: Price Hikes on Lamb, Eggs & Sweets

According to the Greek Consumers’ Institute, hosting an Easter dinner for eight now costs approximately €361.95 — an increase of €11 compared to 2024.

FM Gerapetritis Calls for Unified EU Response to Global Crises at EU Council

"Europe is navigating through unprecedented crises — wars, humanitarian disasters, climate emergencies," he stated.

Holy Week Store Hours in Greece

Retail stores across Greece are now operating on extended holiday hours for Holy Week, following their Sunday opening on April 13. The move aims to accommodate consumers ahead of Easter, but merchants remain cautious amid sluggish market activity.

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης