Greek exports are struggling for the second consecutive year due to the uncertain environment, as insiders of the export sector report. The major question facing the industry now is whether the decline in 2024 will exceed 5%.

Already, the decrease in exports, coupled with a rise in imports, is starting to create a significant problem in the current account balance.

Excluding petroleum products, all sectors, except for food, beverages, and tobacco experienced declines in the first half of the year.

Indicative of the negative outlook is the case of olive oil exports, with a drop in value of over 42%. Given that olive oil exports reached around one billion euros in 2023, this year’s sharp drop poses an additional challenge to the total value of Greek exports.

On the other hand, exports of fish and dairy products such as yogurt and feta cheese continue to perform well. In the beverages and tobacco category, the increase is mainly due to the export of heated tobacco products.

The President of the Panhellenic Exporters Association, Alkiviadis Kalambokis, explained that the challenges facing Greek export activity stem from two key factors: the difficult geopolitical situation and issues arising from domestic inefficiencies.

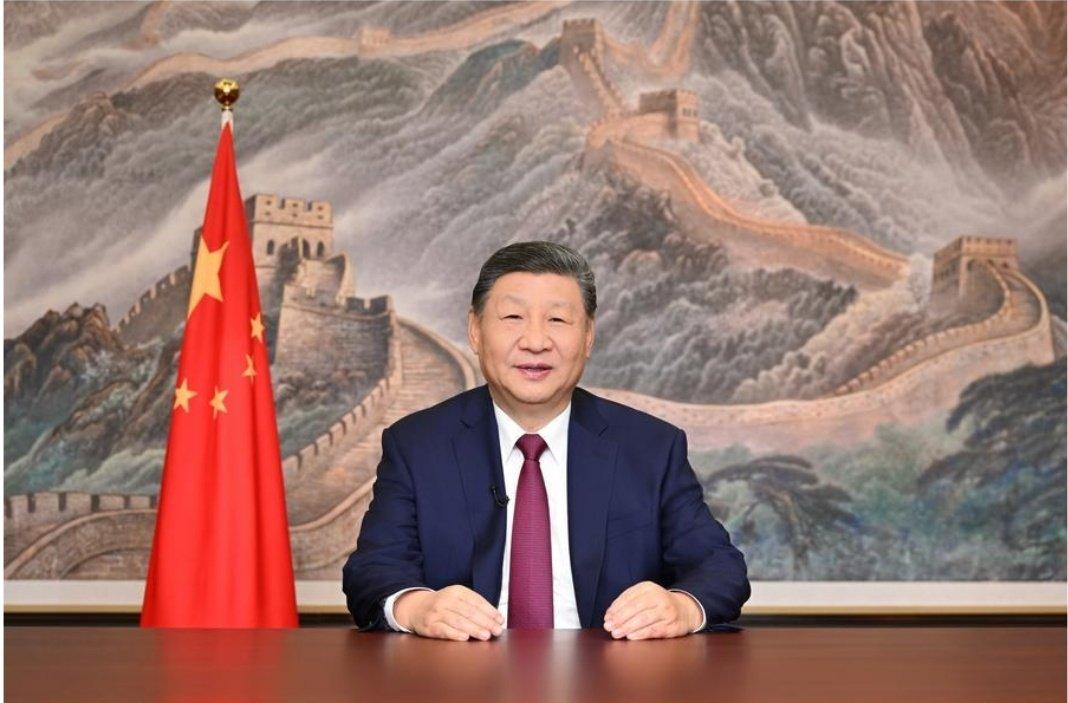

Kalambokis stresses that while the war in Ukraine has seriously impacted the energy sector, raising the cost of Greek products, the ongoing conflict in the Middle East is making markets in Asia, Australia, and the Persian Gulf less accessible for Greek products, further diminishing their competitiveness.

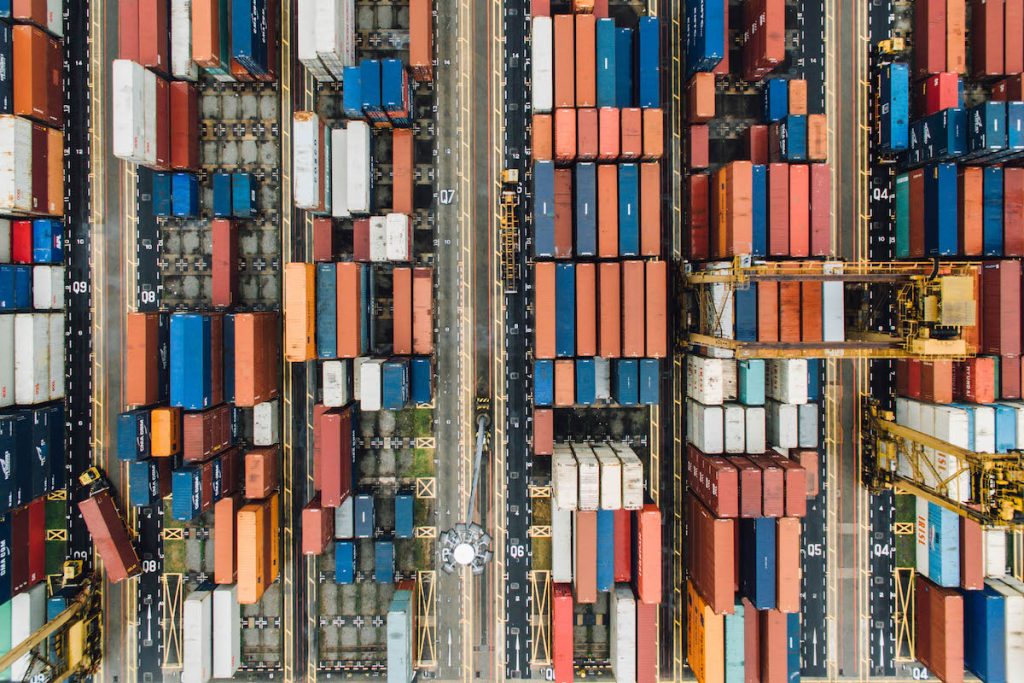

Additionally, fewer goods are being transported through the Suez Canal, and transportation costs are rising due to the choice of longer routes.

The president notes the need to strengthen export companies under the development law and provide tax incentives for these businesses.

What is more, he highlights the importance of these measures at a time when bank financing in Greece is extremely limited, calling for the need of a new program to support export growth within the framework of the Competitiveness Operational Program.

Kalambokis, finally, points out that complex bureaucracy within the public sector, more often than not, act as a barrier to Greek export activity.

Source: tovima.com