The head of Greece’s independent revenue authority (AADE), George Pitsilis, this week referred to his organization’s efforts to curb prolific and stubborn tax evasion and avoidance in the country and to fully digitalize services and monitoring, in his comments at an OECD summit.

For instance, Pitsilis said the myDATA online platform that debuted four years ago has recorded transactions worth 3.5 trillion euros conducted by all businesses registered in Greece.

Additionally, all cash registers in the country must now be linked with POS devices, whereas digital invoicing is now mandatory.

The “digital transformation” has also been extended to bills of lading and transport invoices.

The AADE governor also said the vast majority of quarterly and annual VAT remittance statements – roughly 15 million – along with income tax forms, are automatically calculated over the course the year in real time.

“All this has helped us to drastically reduce the gap in (lost) VAT remittances from almost 30% in 2017 to 13.7% in 2022. Most importantly, however, is implementation of a ‘compliance by design’ strategy that provides us with tools for pro-active compliance, predictive analysis, and more targeted monitoring, yet always with the OECD spirit of Tax Administration 3.0 (the digital transformation of tax administration.”

Latest News

PM Meloni Meets Vice President Vance in Rome Signalling Optimism on Ukraine Talks

Meloni emphasized the strength and strategic value of the Italy-U.S. partnership.

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

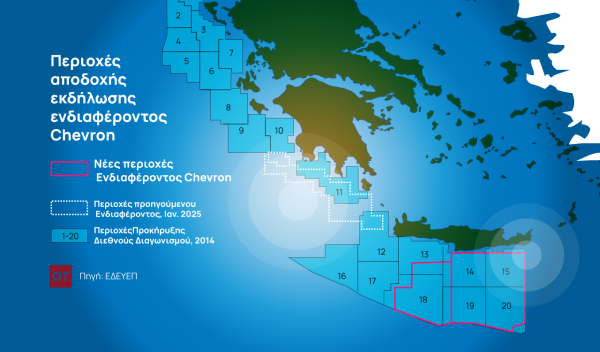

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης